Choosing the best crypto exchange with low fees and high liquidity is one of the most important decisions for any crypto trader—especially beginners. If fees are high, your profits shrink. If liquidity is low, your trades get stuck or executed at bad prices.

This article dives you into all the related topics around crypto exchanges, helping you understand fees, liquidity, and how to choose the best crypto exchange with confidence.

What Is a Crypto Exchange? (Beginner Friendly)

A crypto exchange is an online platform where you can:

-

Buy cryptocurrency (Bitcoin, Ethereum, etc.

-

Sell crypto for profit

-

Trade between coins

-

Store crypto temporarily

Think of it like a stock market, but instead of shares, you trade digital assets.

Why Low Fees & High Liquidity Matter So Much in Crypto Exchange

1. Low Fees = More Profit

Every trade has a cost:

-

Trading fees

-

Maker & taker fees

-

Withdrawal fees

Even small fees add up if you trade often.

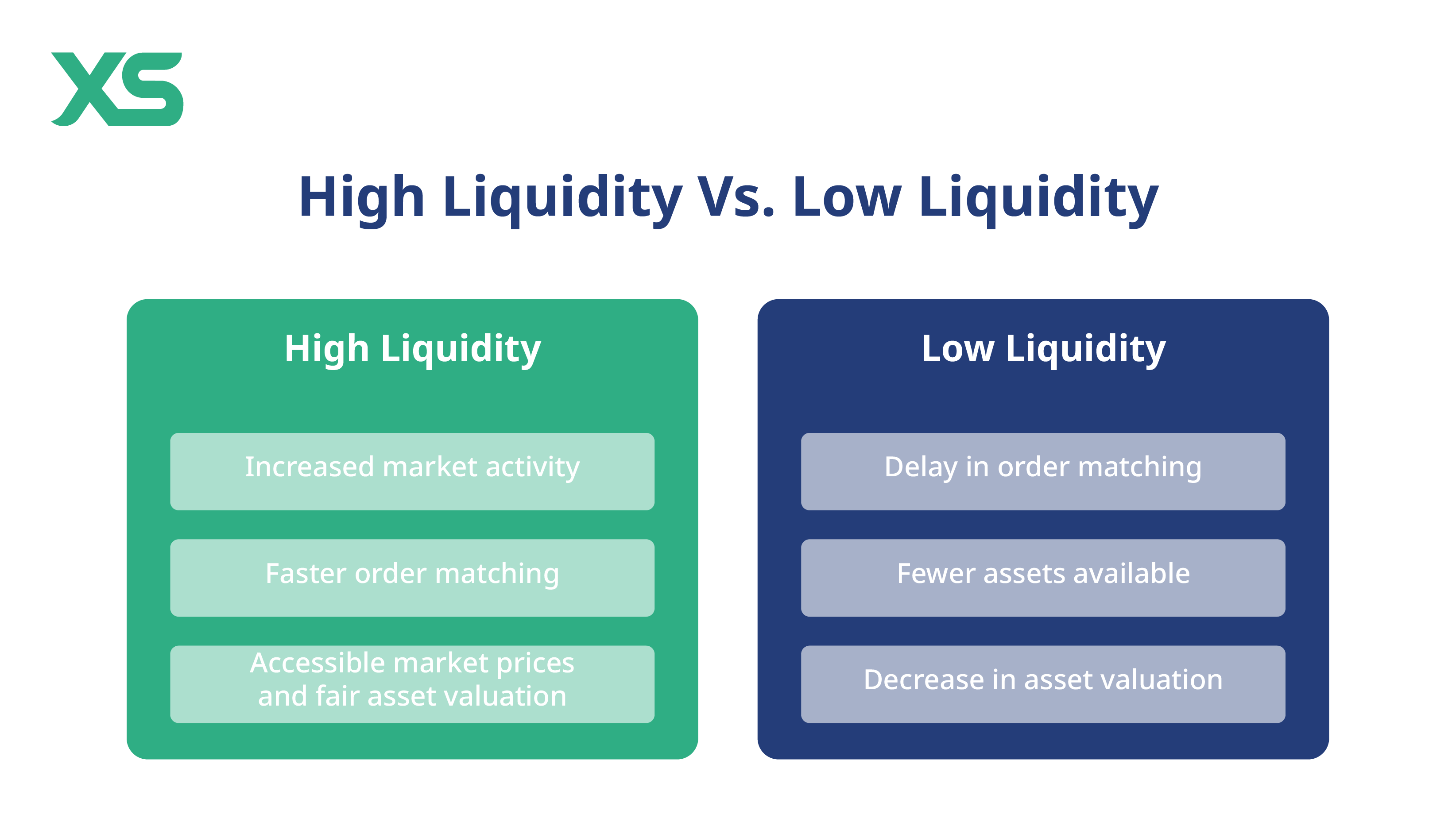

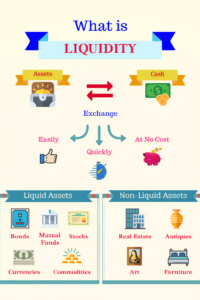

2. High Liquidity = Faster & Fair Trades

In Crypto Exchange Liquidity means:

-

More buyers and sellers

-

Faster order execution

-

No big price difference when you buy or sell

High liquidity is critical for serious traders.

Key Features of the Best Crypto Exchange

Before selecting a crypto exchange, always check these points:

-

✔️ Low trading fees

-

✔️ High daily trading volume

-

✔️ Strong security & reputation

-

✔️ Easy-to-use interface

-

✔️ Good support for beginners

Best Crypto Exchanges With Low Fees & High Liquidity (Comparison)

Choosing the right crypto exchange becomes easier when you compare fees, liquidity, and use case side by side. You can analyze the markets of every exchange by trading volume and fees in coinmarketcap.

Crypto Exchange

Avg Trading Fee

Liquidity Level

Best For

Binance

~0.1%

Very High

Beginners, spot & futures traders

Bybit

~0.06%–0.1%

High

Futures & active traders

OKX

~0.08%–0.1%

High

Advanced trading & tools

Coinbase

Higher (varies)

Very High

Beginners & long-term investors

KuCoin

~0.1%

Medium–High

Altcoin traders

Kraken

~0.16%–0.26%

High

Security-focused traders

Bitget

~0.06%–0.1%

High

Copy trading & futures

MEXC

Very Low

Medium–High

Zero-fee promotions

Gate.io

~0.1%

Medium–High

Wide coin selection

Pionex

~0.05%

Medium

Built-in trading bots

How Liquidity Affects Your Trades (Easy Explanation)

Imagine you want to sell Bitcoin quickly:

-

On a high-liquidity exchange, it sells instantly at the right price.

-

On a low-liquidity exchange, price slips and you lose money.

That’s why liquidity is just as important as fees.

How to Check If a Crypto Exchange Has High Liquidity

You don’t need advanced knowledge. Just check:

-

Daily trading volume (higher = better)

-

Tight buy/sell price gap

-

Fast order execution

-

Popular coins always active

Is a Low-Fee Crypto Exchange Always the Best?

Not always.

Sometimes:

-

Very low fees = low liquidity

-

Or weak security

-

Or poor customer support

The best crypto exchange balances:

Low fees + high liquidity + trust

During sudden price moves:

-

High liquidity = smooth buying & selling

-

Low liquidity = sharp price jumps and losses

This is why professional traders never ignore liquidity, even if fees are low.

Can Beginners Lose Money Because of High Fees?

Yes, and it happens often.

High fees can:

-

Eat profits silently

-

Turn winning trades into losing ones

-

Slow portfolio growth

That’s why choosing the right crypto exchange from day one matters.

Which Coins Have the Highest Liquidity on Most Exchanges?

Most crypto exchanges have the highest liquidity for:

-

Ethereum (ETH)

-

Stablecoins like USDT

Trading popular pairs means:

-

Faster execution

-

Better prices

-

Lower risk of slippage

How to Choose a Crypto Exchange as a Beginner (Step-by-Step)

If you’re new, follow this simple checklist:

-

Start with spot trading

-

Choose an exchange with high daily volume

-

Check trading fees clearly

-

Avoid unknown or new platforms

-

Use small amounts first

This approach keeps learning safe and stress-free.

Are Zero-Fee Crypto Exchanges Really Safe?

Some platforms advertise zero trading fees, but:

-

Liquidity may be low

-

Spreads may be higher

-

Withdrawals may cost more

Always look at the full fee structure, not just one number.

How Long Does It Take to Learn a Crypto Exchange?

For beginners:

-

1–2 days to understand basics

-

1 week to place confident trades

-

1 month to understand fees & liquidity deeply

Common Mistakes Beginners Make When Choosing a Crypto Exchange

Avoid these mistakes:

-

Choosing based only on bonuses

-

Ignoring liquidity

-

Trading with full capital early

-

Not understanding fees

-

Using too many exchanges at once

One good exchange is better than five confusing ones.

Is a High-Liquidity Crypto Exchange Better for Long-Term Holding?

Yes.

High liquidity exchanges usually:

-

Have stronger security

-

Support major coins

-

Offer stable withdrawals

They are safer for both trading and holding crypto temporarily.

Most Asked Google Questions (FAQs)

Q1. Which crypto exchange has the lowest fees?

it depends on what you trade (spot vs futures), whether you use native-token discounts or VIP tiers, and which country’s rules apply. That said, among big global exchanges Binance, KuCoin, Bybit, OKX and Kraken are consistently ranked as the cheapest for active traders (especially if you use discounts or hit volume tiers).

Q2. Why is liquidity important in crypto trading?

Liquidity ensures your trades execute fast and at fair prices, especially during market volatility.

Q3. Is high liquidity good for beginners?

Yes. Beginners benefit from smooth trades and less price fluctuation.

Q4. Can low liquidity cause losses?

Yes. Low liquidity can cause slippage, meaning you buy higher or sell lower than expected.

Q5. Should beginners choose spot trading first?

Yes. Spot trading on a high-liquidity crypto is safest for beginners.

Final Thoughts: Which Crypto Exchange Should You Choose?

If you’re serious about crypto trading in 2026:

-

Don’t chase only low fees

-

Don’t ignore liquidity

-

Don’t compromise on trust

The best crypto exchange is one that:

-

Saves your money on fees

-

Executes trades instantly

-

Feels simple and safe to use

Start small, learn gradually, and always trade responsibly.

⚠️ Disclaimer

Cryptocurrency trading involves risk. This article is for educational purposes only and not financial advice.